Absorption Costing vs Variable Costing: What’s the Difference?

Period costs include all overheads related to the organization, sales, and distribution. As a result, profits get subtracted from the time in which they take place. As long as the company could correctly and accurately calculate the cost, there is a high chance that the company could make the correct pricing for its products. General or common overhead costs like rent, heating, electricity are incurred as a whole item by the company are called Fixed Manufacturing Overhead. You should charge sales and administrative costs to expense in the period incurred; do not assign them to inventory, since these items are not related to goods produced, but rather to the period in which they were incurred.

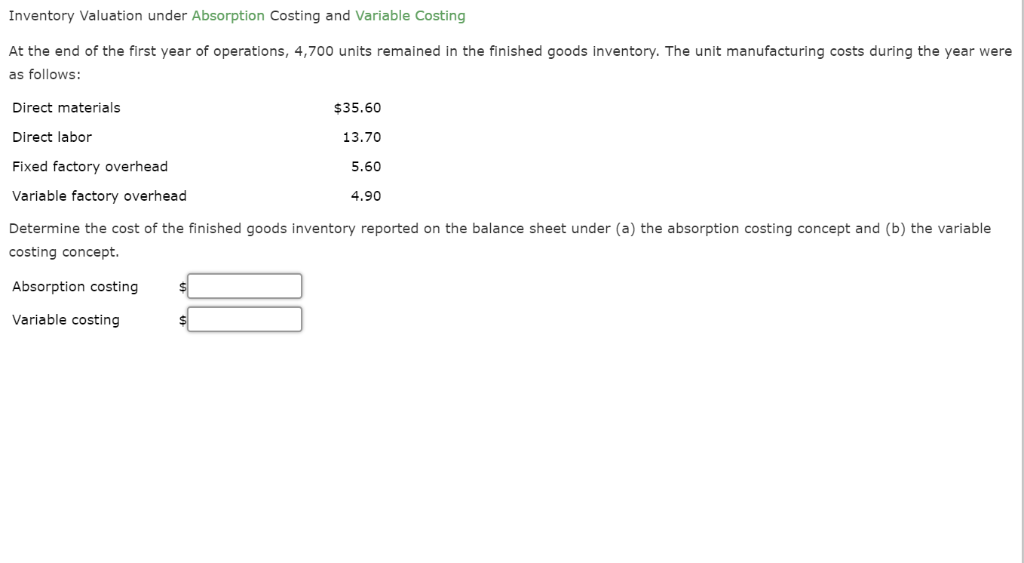

Absorption Costing: Definition, Formula, Calculation, and Example

When a company uses standard costing, it derives a standard amount of overhead cost that should be incurred in an accounting period, and applies it to cost objects (usually produced goods). If the actual amount of overhead turns out to be different from the standard amount of overhead, then the overhead is said to be either under absorbed or over absorbed. If overhead is under absorbed, this means that more actual overhead costs were incurred than expected, with the difference being charged to expense as incurred. This usually means that the recognition of expense is accelerated into the current period, so that the amount of profit recognized declines. The absorbed-cost method takes into account and combines—in other words, absorbs—all the manufacturing costs and expenses per unit of a produced item, ones incurred both directly and indirectly. Some accounting systems limit the absorbed cost strictly to fixed expenses, but others include costs that can fluctuate as well.

Is Variable Costing More Useful Than Absorption Costing?

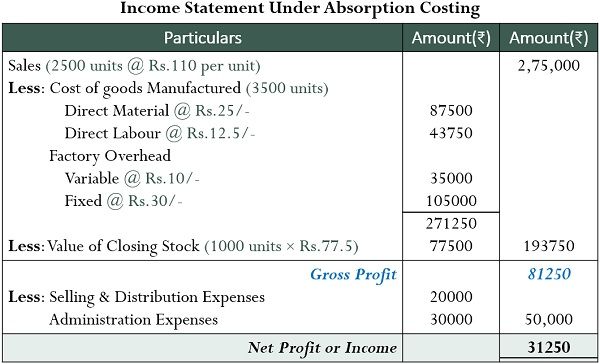

Direct costs are those costs that can be directly traced to a specific product or service. These costs include raw materials, labor, and any other direct expenses that are incurred in the production process. Absorption costing leads to more accurate product costs than variable costing, which only includes direct costs. However, absorption costing depends heavily on cost estimates and output assumptions. So in summary, absorption costing income statements allocate all manufacturing costs (variable and fixed) to inventory produced.

Absorption Costing vs. Variable Costing Example

In summary, absorption costing principles provide businesses with an accurate, GAAP-compliant accounting method to incrementally track product profitability changes tied to production volumes. By fully loading costs into inventory valuations, absorption costing helps prevent distortions and presents a transparent view of operations. The key difference in calculating the income statement under absorption 5 tax tips for the newest powerball millionaires costing versus variable costing is in how fixed manufacturing costs are handled. Absorption costing is an accounting method used to determine the full cost of producing a product or service. By allocating fixed overhead to units produced, absorption costing provides a more complete assessment of production costs. However, it can result in over- or under-costing inventory if production volumes fluctuate.

- Discover the top 5 best practices for successful accounting talent offshoring.

- Depending on whether fixed manufacturing costs are assigned to units or not, there are two possible approaches to finding cost of units produced, namely absorption costing and variable costing (also called marginal costing).

- If overhead is under absorbed, this means that more actual overhead costs were incurred than expected, with the difference being charged to expense as incurred.

- It is sometimes called the full costing method because it includes all costs to get a cost unit.

- Throughout the production process, you’ll need to calculate usage for activities.

Absorption costing is a method in which cost of units produced is calculated as the sum of both the variable manufacturing costs incurred and the fixed manufacturing costs allocated to those units. Absorption costing is an inventory valuation method that allocates all manufacturing costs, including both variable costs and fixed overhead costs, to the units produced. This means that inventory is valued to include both direct costs of materials and labor as well as a portion of fixed manufacturing overhead costs. In this example, using absorption costing, the total cost of manufacturing one unit of Widget X is $28.

Calculating Total Cost: Absorption Costing Method

Depreciation is considered a fixed cost in absorption costing because it remains constant regardless of production levels. In periods where production declines, the opposite effect happens – fixed costs are released from inventory, increasing cost of goods sold and lowering net income. With a higher COGS under absorption costing, gross margin is lower compared to variable costing.

External reports are generated for public consumption; in the case of publicly traded corporations, shareholders interact with external reports. External reports are designed to reveal financial health and attract capital. To apply predetermined absorption rates, the actual value (i.E., The actual number of units or any other actual base data such as direct labor hours or machine hours) is multiplied by the predetermined rate. To apply predetermined absorption rates, the actual value (i.e., the actual number of units or any other actual base data such as direct labor hours or machine hours) is multiplied by the predetermined rate. It is best suited to those units of production where overheads depend on both direct materials and direct labor. We know that both direct materials and direct labor determine the nature of overheads.

Also, net income increases as more items are produced, because fixed costs are spread across all units manufactured. In corporate lingo, “absorbed costs” often refer to a fixed amount of expenses a company has designated for manufacturing costs for a single brand, line, or product. Absorbed cost allocations for one product produced may be greater or lesser than another. The absorption costing method is typically the standard for most companies with COGS. Auditors and financial stakeholders will require it for external reporting. Small businesses may also be required to use absorption costing for their tax reporting depending on their type of business structure.

It’s important to note that period costs are not included in full absorption costing. In other words, a period cost is not included within the cost of goods sold (COGS) on the income statement. COGS are the costs directly involved in production, such as inventory. Instead, period costs are typically classified as selling, general and administrative (SG&A) expenses, whether variable or fixed. The overall difference between absorption costing and variable costing concerns how each accounts for fixed manufacturing overhead costs. Under absorption costing, the inventory carries a portion of fixed overhead costs in its valuation.