Balance Sheet Definition, Example, Formula & Components

It is crucial to note that how a balance sheet is formatted differs depending on where the company or organization is based. As you can see, it starts with current assets, then the noncurrent, and the total of both. Like assets, liabilities can be classified as either current or noncurrent liabilities. Noncurrent assets include tangible assets, such as land, buildings, machinery, and equipment.

Add Total Liabilities to Total Shareholders’ Equity and Compare to Assets

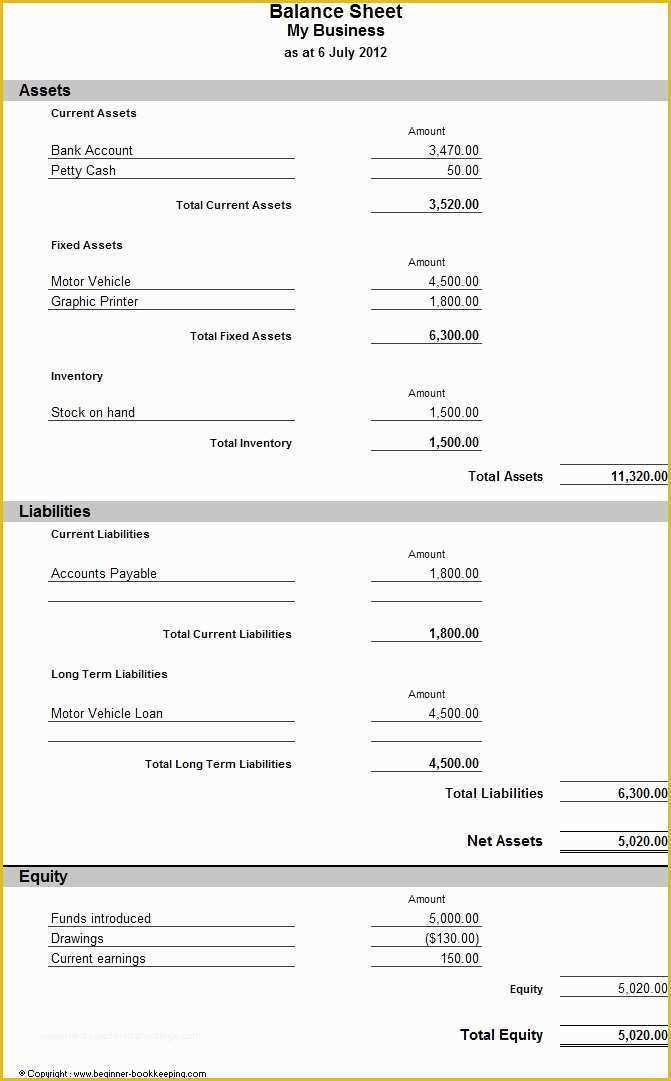

Without knowing which receivables a company is likely to actually receive, a company must make estimates and reflect their best guess as part of the balance sheet. Assets, liabilities, and stockholders’ equity are three features of a balance sheet. For this example, we’ll use this hypothetical balance sheet of ABC Company, an industrial manufacturer. The table below summarizes the company’s assets for the past two year-end periods.

Balance Sheets Secure Capital

The balance sheet is a report that gives a basic snapshot of the company’s finances. This is an important document for potential investors and loan providers. The data keep ghosts off the payroll and information included in a balance sheet can sometimes be manipulated by management in order to present a more favorable financial position for the company.

Forensic Accounting Summit Q&A

- Most of the information about assets, liabilities, and owners’ equity items is obtained from the adjusted trial balance of the company.

- We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan.

- This could signify financial trouble if the debt is not being paid back.

- To judge leverage, you can compare the debts to the equity listed on your balance sheet.

External auditors, on the other hand, might use a balance sheet to ensure a company is complying with any reporting laws it’s subject to. Typically, a balance sheet will be prepared and distributed on a quarterly or monthly basis, depending on the frequency of reporting as determined by law or company policy. If a company or organization is privately held by a single owner, then shareholders’ equity will be relatively straightforward.

What Is A Balance Sheet? (Example Included)

The Balance Sheet and Profit and Loss Statement are essential reports for understanding your business’s financial health. You should review these reports regularly to ensure your company is financially stable. It lets you see a snapshot of your business on a given date, typically month or year-end.

Calculating the change in assets of a company

This document gives detailed information about the assets and liabilities for a given time. Using these details one can understand about company’s performance. By analysing balance sheet, company owners can keep their business on a good financial footing. This includes debts and other financial obligations that arise as an outcome of business transactions. Companies settle their liabilities by paying them back in cash or providing an equivalent service to the other party.

The assets should always equal the liabilities and shareholder equity. This means that the balance sheet should always balance, hence the name. If they don’t balance, there may be some problems, including incorrect or misplaced data, inventory or exchange rate errors, or miscalculations. The NERF measures available stable resources after financing fixed assets. A negative NERF, on the other hand, suggests a potential financial risk requiring corrective measures such as a capital increase or recourse to long-term debt.

Depicting your total assets, liabilities, and net worth, this document offers a quick look into your financial health and can help inform lenders, investors, or stakeholders about your business. Based on its results, it can also provide you key insights to make important financial decisions. These provide additional information pertaining to a company’s operations and financial position and are considered to be an integral part of the financial statements. Balance sheets can be used to analyze capital structure, which is a combination of your business’ debt and equity. Lenders will factor them into their decisions when doing risk management for credit.

On the other hand, long-term liabilities are long-term debts like interest and bonds, pension funds and deferred tax liability. Unlike the asset and liability sections, the equity section changes depending on the type of entity. For example, corporations list the common stock, preferred stock, retained earnings, and treasury stock. Partnerships list the members’ capital and sole proprietorships list the owner’s capital. In both formats, assets are categorized into current and long-term assets.

This could signify financial trouble if the debt is not being paid back. The balance sheet is organised into distinct sections, each displaying the total of corresponding accounts along with their respective sub-accounts and balances. This structured layout enhances readability and provides a clear overview of the totals for each account.